Gross salary to hourly rate calculator

SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes. Daily wage to hourly rate.

Hourly Rate Calculator

If you get paid bi-weekly once every two weeks your gross paycheck will be 1 731.

. A yearly salary of 45 000 is 2163 per hourThis number is based on 40 hours of work per week and assuming its a full-time job 8 hours per day with vacation time paid. Our tool takes a gross salary and calculates the net salary based on current tax rates and the following deductible amounts. Wondering what hourly rate you earn on a 50k annual salary in Ontario.

Semi-Monthly Salary Annual Salary 24. Regular Hours per Year Regular Hours per Day X 261 Work Days per Year. Gross annual income - Taxes - CPP - EI Net annual salary.

Federal Filing Status. For example suppose an engineer in Ontario makes 80 000 in gross salary. Federal income tax rates range from 10 up to a top marginal rate of 37.

To show the process in action we are going to use an annual gross salary of. This federal hourly paycheck calculator is perfect for those who are paid on an hourly basis. Any wage or salary amount calculated here is the gross income.

Pay Frequency Use 2020 W4. If you get paid bi-weekly once every two weeks your gross paycheck will be 2308. If you make 60000 a year how much is your salary per hour.

Quarterly Salary Annual Salary 4. To calculate your hourly rate from your annual salary please refer to the chart below. Calculating Hourly Rate Using Annual Salary.

Enter your info to see your take home pay. What is my hourly rate if my annual salary is. She is left with 59556 for herself after removing 10 822 for federal taxes 5 567 for provincial taxes and 4 056 for CPP and EI contributions.

Take for example a salaried worker who earns an annual gross salary of 65000 for 40 hours a week and has worked 52 weeks during the year. Switch to salary calculator. On a 60k salary or a 40k salary.

A salary calculator will allow you to enter your gross income and the number of hours you work per week to calculate how much you earn monthly weekly daily and hourly. Annual Salary Hourly Wage Hours per workweek 52 weeks. HoursWeek HoursDay Work DaysYear HoursYear.

It assumes 40 hours worked per week and 20 unpaid days off per year for vacation and holidays. Add Rate Remove Rate. Weekly Salary Daily Salary Days per workweek.

Please note this is based on a 40 hour work week with 52 weeks per year and 12 months per year. A yearly salary of 60000 is 3077 per hourThis number is based on 375 hours of work per week and assuming its a full-time job 8 hours per day with vacation time paid. Enter your regular annual salary numerals only to calculate your bi-weekly gross.

120 per day 8 hours 15 per hour. Weekly paycheck to hourly rate. Enter Your Regular Annual Salary.

Annual salary to hourly wage 50000 per year 52 weeks 40 hours per week 2404 per hour. Take for example a salaried worker who earns an annual gross salary of 45000 for 40 hours a week and has worked 52 weeks during the year. Federal Income-- --State Income-- --.

Net weekly income Hours of work per week Net hourly wage. 1500 per week 40 hours per week 3750 per hour. You will see the hourly wage weekly wage monthly wage and annual salary based on the amount given and its pay frequency.

Whereas gross salary is the amount you pay. Net annual salary Weeks of work per year Net weekly income. Net annual salary Weeks of work per year Net weekly income.

VND 11000000 Eleven million for the tax payer VND 4400000 for per dependant of the tax payer Social insurance contribution 8 Health insurance contribution 15 Unemployment insurance contribution 1. The formula of calculating annual salary and hourly wage is as follow. Switch to California salary calculator.

The fastest and easiest way to calculate your hourly rate is to use a salary calculator. To calculate annual salary to hourly wage we. Gross Paycheck --Taxes-- --Details.

If you make 45 000 a year how much is your salary per hour. Biweekly Salary Annual Salary 26. For example if youre a salaried employee with a 20000 annual salary but you received an incentive bonus of 2000 your gross salary is 22000.

Net weekly income Hours of work per week Net hourly wage. The 40 hour work week is 5 8 hour days. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

Monthly Salary Annual Salary 12. Monthly wage to hourly wage 5000 per month 12 52 weeks 40 hours per week 2885. If you are paid an hourly rate you are considered an hourly employee and.

To calculate annual salary to hourly wage we use this.

Hourly To Salary What Is My Annual Income

How To Calculate Gross Weekly Yearly And Monthly Salary Earnings Or Pay From Hourly Pay Rate Youtube

Annual Income Calculator

Gross Pay And Net Pay What S The Difference Paycheckcity

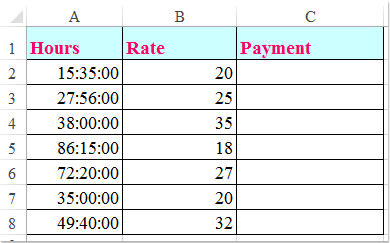

How To Multiply Hours And Minutes By An Hourly Rate In Excel

Hourly To Annual Salary Calculator How Much Do I Make A Year

8 Hourly Paycheck Calculator Doc Excel Pdf Free Premium Templates

Salary Calculator Hourly Rate Sale Online 58 Off Clinica Dental Tenerifesur Com

Salary To Hourly Salary Converter Salary Hour Calculators

Salary Calculator Hourly Rate Sale Online 58 Off Clinica Dental Tenerifesur Com

3 Ways To Calculate Your Hourly Rate Wikihow

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy

Hourly To Salary Calculator Convert Your Wages Indeed Com

Calculating Income Hourly Wage Youtube

Hourly To Salary Calculator

How To Calculate Net Pay Step By Step Example

Salary Calculator